The local Audio advertising marketplace is becoming more competitive with more streaming services and podcasts. While the shares of local Radio OTA (Over-the-Air) advertising is eroding, Radio Digital is increasing, providing Radio Stations an avenue to still increase their sales. Overall, BIA forecasts $14.7 billion will be spend in ad-supported local audio platforms including broadcast radio and digital audio. BIA’s full audio forecast covers the 2019-2026 time period.

BIA’s local Audio estimate breaks out advertising revenue forecast for 2022 from each of these local ad-supported local audio platforms:

- Radio OTA (Over-the-Air) – ($12.7 billion) All revenues generated by local radio stations for sale of time to either national or local advertisers from their over-the-air broadcasts. Does not include any advertising sold by the national radio networks.

- Radio Digital – ($1.7 billion) All revenues generated by local radio stations from national, regional and local advertisers targeting a local market from their online activities. Includes display and streaming advertising revenue other than Pandora.

- Pandora – ($400 million) Audio and display advertising revenue generated by Pandora from national, regional and local advertisers targeting a local market.

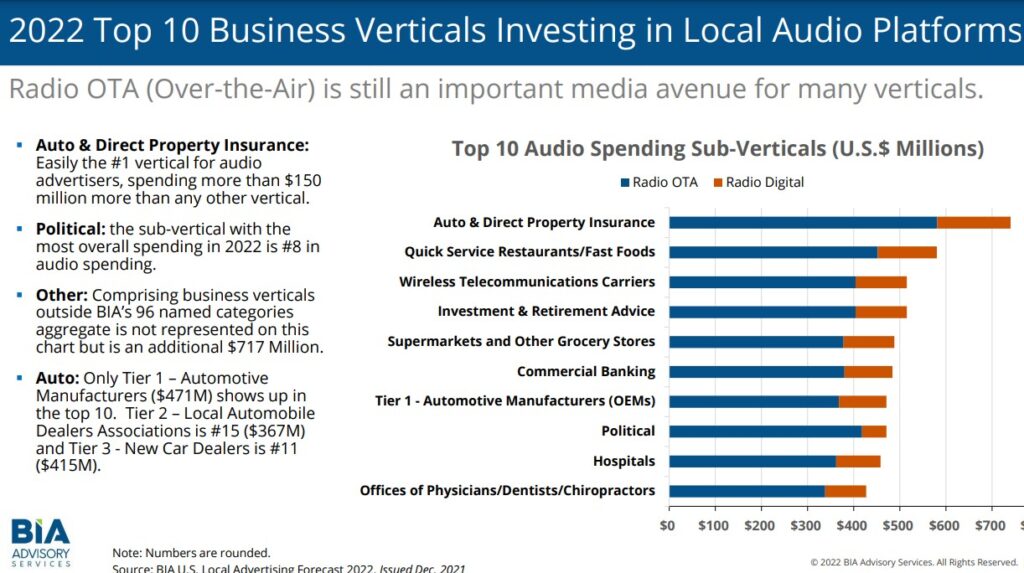

BIA provides local audio forecast data for each of the 253 Radio Markets and across 96 business verticals. Overall, the Top 10 business verticals spending in local radio’s OTA and Digital platforms are shown in the chart below, led by Auto & Direct Property Insurance and QSR/Fast Foods, each of which are the top spending in both the broadcast and digital radio categories.

The full Local Audio Advertising Forecast for 2019-2022 is available for purchase here. If you are a BIA ADVantage client, login in now to download the full forecast deck.

For more information about BIA’s local ad market forecasting products and services across business verticals and media channels, please contact us and we’ll be happy to provide more information.