Looking at the last two years offers insights into the broadcast transaction landscape. Let’s start with television.

The 2021 and 2022 television transaction landscape was marked by megadeals by Gray and Standard General.

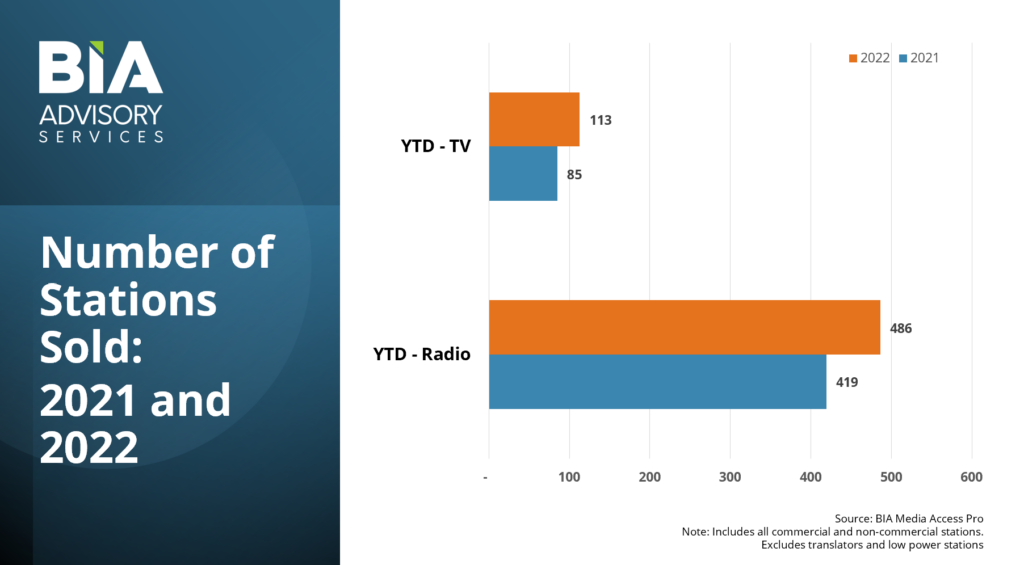

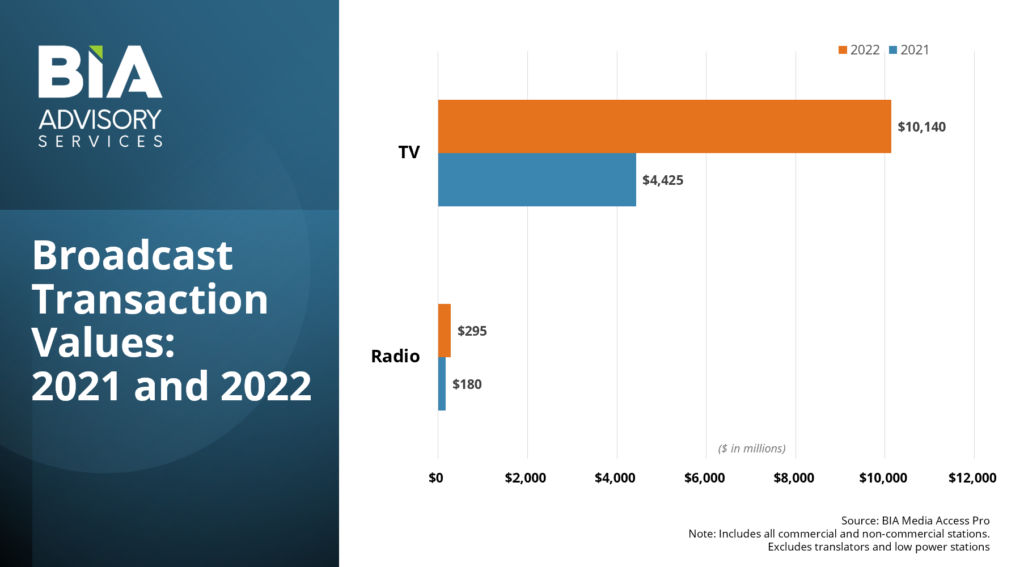

Total TV deal volume more than doubled in 2022 to $10.14 billion[1] compared to 2021. Approximately 85% of the 2022 deal volume is from the Standard General’s proposed acquisition of TEGNA, with an enterprise value, including debt, of about $8.6 billion. While the deal was announced in February 2022, it hadn’t yet closed as of late January 2023 as the FCC review of the merger drags on.

The second largest transaction of 2022 is slated to immediately follow consummation of the Standard General/TEGNA transaction, when KVUE (Austin), KMPX (Dallas, and KHOU and KTBU (Houston) will be assigned to Cox Media Group for an aggregate purchase price of $914 million.

The only other $100 million-plus TV deal in 2022 is INSP, LLC’s entry into local television with the purchase of Cox Media Group’s 20 full power/Class A/LPTV stations in 12 markets ranked from 52 (Memphis) to 195 (Eureka, CA).

Total 2021 TV sales volume registered $4.425 million. Gray Television, Inc. led the way with $3.75 billion in total acquisitions and the two largest deals of the year (Meredith Corp.’s 17 stations in 12 markets for $2.825 billion and Quincy Media’s 18 stations in 16 markets for $925.0 million). To comply with FCC and DoJ regs, Gray sold ten of the Quincy stations in seven markets to Allen Media for $380 million for the third highest value transaction in 2021. With four buys totaling $482.5 million, Allen Media ranked second for TV acquisitions. Rounding out the top three most active buyers of 2021, Weigel Broadcasting Company purchased three full powers and four Class As totaling $118.5 million.

The radio deal market can best be described as sluggish in the past two years.

Radio deal volume[2] increased by nearly two-thirds in 2022, from $179.7 million to $295.2 million. Despite the increase, it has been decades since radio deal volume has been this low. The biggest sale of 2022 was the newly formed Latino Media Network purchase of eight FMs and ten AMs in ten markets from TelevisaUnivision. The second and third largest deals of 2022 were Urban One’s purchase of three FMs in Indianapolis from Emmis (for $25 million) and Townsquare’s acquisition of Cherry Creek’s 39 radio stations in nine markets (for $18.75 million). All totaled, there were just seven radio buys of $10.0 million or more in 2022.

The highest priced radio deal in 2021 was for just over $18.0 million, when Lotus Communications purchased two AMs and two FMs in the Seattle radio market from Sinclair. In the second largest transaction of the year, Good Karma purchased three AMs in New York, LA, and Chicago from ABC/Disney for a $15.0 million price tag. The third largest deal occurred when VCY America bought KESN-FM (now KVDT) from ABC/Disney for $9.25 million and converted its commercial Sports format to a noncommercial Christian format.

BIA continuously tracks all television and radio transactions and reports them in its MEDIA Access Pro™ (MAPro) database, which offers the comprehensive details into the broadcasting and publishing industries. Contact us to discuss subscription information.

If you are considering the sale or purchase of a station, BIA’s valuation team can assist. Please see our portfolio here and contact us to discuss your project at no obligation.

[1] Includes announced sales of full power and Class A TV stations.

[2] Includes announced sales of commercial full power AM and FM stations.