Pick your target. Know what you are up against. Maximize your local budget. All simple rules of thumb that marketers use when deciding where and how much to advertise. But within each local media market, there can be significant variability in spending by channel and business category. Using national averages can be very misleading.

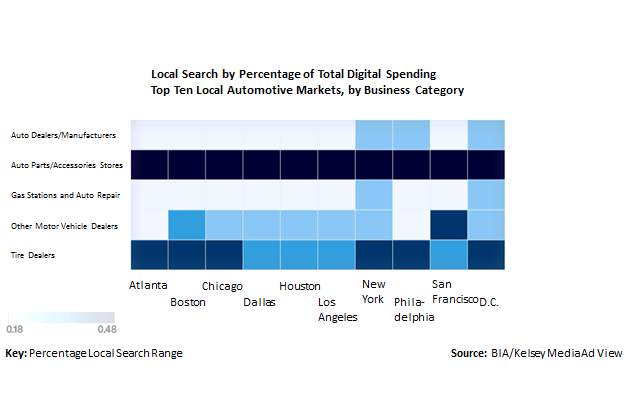

For example, let’s look at just one aspect of local digital spending in the Los Angeles automotive market using data from BIA/Kelsey’s Media Ad View database of local media spending. As a percentage of total spending on digital channels, automotive businesses allocate between 18 percent and 48 percent of their advertising to local search. Different business categories within the automotive market, including manufacturers and dealers, auto parts stores, gas stations and auto repair, and tire dealers, spend very differently.

Local Search by Percentage of Total Digital Spending Top Ten Local Automotive Markets, by Business Category

These differences in spending by companies in the same business categories can be striking. Used car dealers in San Francisco, for example, defy the norm at 38 percent of total local digital spending. Boston, at 33 percent of local digital spend dedicated to search, comes in seven percent ahead of the third-highest markets, Houston and Los Angeles, which report 26 percent of their digital spend goes to search.

Auto dealers in Los Angeles limit search marketing, spending only 20 percent in 2016, while New York car dealers spend 29 percent of their digital budget on search. A dealer entering the Los Angeles market could spend heavily on search to gain on its less aggressive competitors.

There are, however, consistent patterns in the Top Ten local media markets. Auto parts and accessories stores spend almost half their digital budget on search. None of the auto parts markets saw less than 43 percent spend on search. Gas stations and repair shops, too, spend between 18 percent and 25 percent on search advertising.

Marketers need to look closely at the spending of local competitors instead of relying on national averages to plan their budgets. In the next posting, we’ll look at the inevitable increase in channels and how it increases the importance of close examination of local market features — new channels represent beachheads for customer engagement.