The rise of Retail Media Networks (RMNs) is reshaping the world of advertising. These digital platforms, operated by retail giants such as Amazon and Walmart, offer a new avenue for brands and agencies to connect with their target audience, amplify their reach, and track ad performance in ways traditional paid media platforms cannot.

The main appeal for RMNs lies in their ability to leverage first-party data for segmentation and better attribution, which can be a game-changer for advertisers. All of this in turn creates new competition for local media, which is what BIA has been examining and has published a report available for free download.

To examine this emerging advertising avenue, BIA has prepared a report on RMNs to examine their meteoric rise, their investment dynamics, and key players shaping this landscape. Our objective with the report is to help local media companies and local advertisers better understand the potential opportunities, as well as challenges presented by these RMNs.

We are offering the paper, Retail Media Networks (RMN): A Local Perspective, for free download here. Plus, I discuss the paper with BIA’s Managing Director, Rick Ducey, here on a recent podcast.

Here are a few takeaways from the analysis we offer in the report:

- RMNs will boast an estimated $45.2 billion in ad spend by 2023 according to eMarketer.

- BIA estimates that local retail advertising, which does not include RMN data, contributes the largest portion to total local U.S. advertising spend at $25 billion in 2023, a growth of 8.2% from 2022.

- Retail Media Networks and paid media opportunities can coexist and benefit from each other. While retail media networks primarily operate on a national level, they play a significant role in the local market and present a significant opportunity for local sellers to reach a broader audience.

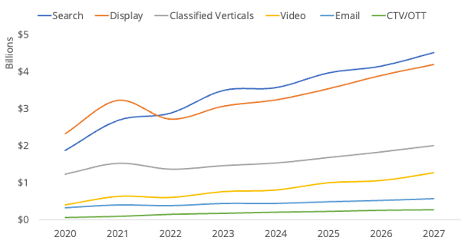

- RMN ad revenue is growing away from search ad formats into other digital ad formats including video. Video ads drive a more immersive experience for consumers, therefore leading to higher engagement and conversion rates. Video ads are a great medium to instore seamless experience across multiple touchpoints, from retailers’ sites to CTV to brick-and-mortar stores. To illustrate the growth in local video, the graphic below shows BIA’s U.S. Local Advertising Forecast for Local Retail Digital Ad Spend.

- Retail Media Networks offer enhanced audience reach for traditional paid media platforms. Their vast and diverse customer base provides valuable access for media platforms looking to improve their engagement levels.

The rise of Retail Media Networks is setting the stage for the future of advertising. Whether you are a retailer, a brand, an agency, or a traditional paid media platform, understanding the potential RMNs could have a positive effect on your advertising strategy.

BIA will continue to examine RMNs and offer even more insights in 2024. We invite you to download our report and listen to the podcast. Questions? Reach out to us and let us know what other topics around RMNs you’d like us to cover.