At the start of every year, BIA surveys the media industry to do a comprehensive assessment of advertising revenue. In parallel, the forecast team examines the advertising marketplace and the economy noting changes affecting spend.

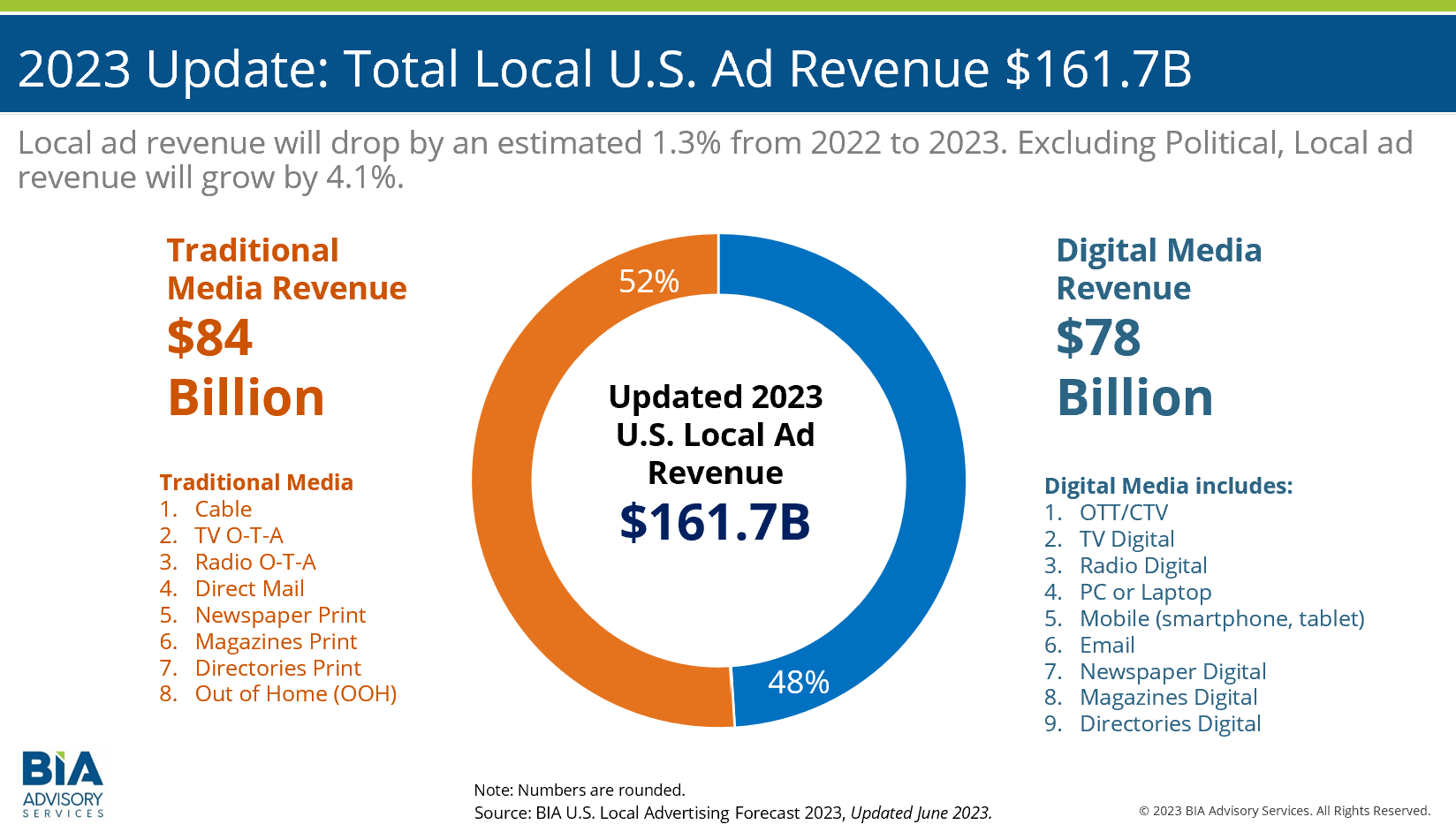

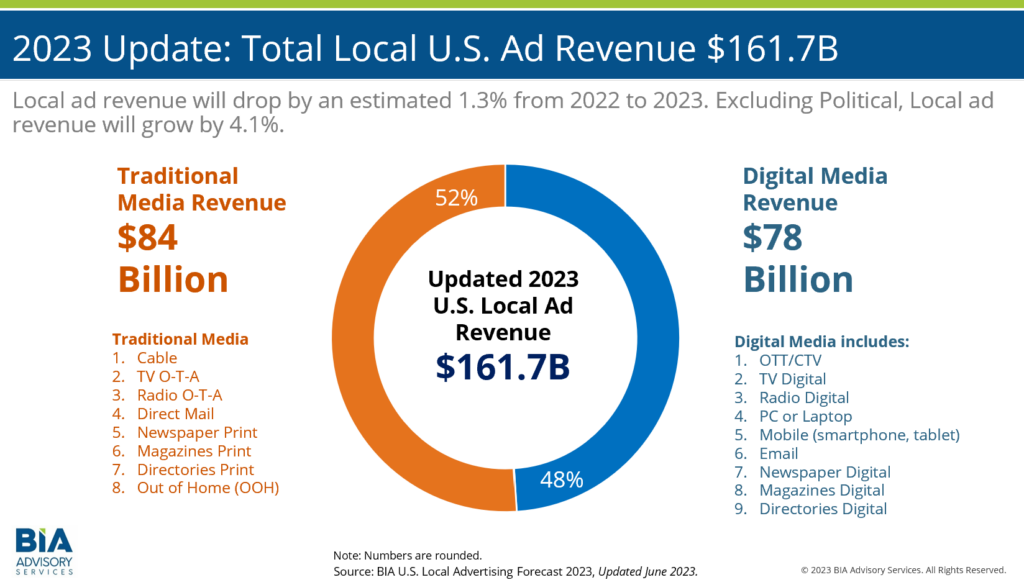

This year, a couple of major issues bubbled to the top. Digital advertising has contracted, and interest rates are affecting spend in big local business categories. These issues (and others) support lowering our estimate of total local advertising to total $161.7 billion for the year, down from our original estimate of $165.7B.

Our forecasting VP, Nicole Ovadia, and Managing Director, Rick Ducey, offer more analysis in the announcement below and discuss breakout media channel CTV/OTT. (Note: If you are a client, the updated local advertising forecast for both nationwide and local markets is in BIA ADVantage™ and local television revenue has been updated in MEDIA Access Pro™.)

—

Chantilly, VA (June 28, 2023) – BIA Advisory Services has decreased its 2023 U.S. Local Advertising Forecast estimate to $161.7 billion, from its original estimate of $165.7 billion due to a mixed start in the economy this year and the tempered growth in digital advertising.

“After Meta, Alphabet and others lowered expectations for 2023, we examined local digital advertising spending revenues over the first six months of the year and determined a reduction was necessary,” said Nicole Ovadia, VP Forecasting and Analysis, BIA Advisory Services. “After years of double-digit growth, we are seeing some headwinds that will have a significant impact on digital local advertising. For traditional media, while we’ve made changes to certain media and categories throughout our forecast, the total ad forecast for this segment remains consistent with our original expectations.”

BIA’s updated U.S. Local Advertising Forecast for 2023 shows traditional media will earn $84 billion, with digital revenue reduced from an original estimate of $81 billion to $78 billion. BIA defines TV digital to include all digital advertising sold by local broadcast stations excluding Connected TV/Over-the-Top (CTV/OTT). This includes mobile apps, search, social, Owned & Operated inventory, banner ads, etc.

Taking political out of the expected ad spend this year, key indicators for media channels in 2023 include the following:

- The top three paid media channels for 2023 include Direct Mail ($37B), Mobile ($32B), and PC/Laptop ($28B).

- CTV/OTT is still slated to be the fastest-growing (18.5 percent this year), with an estimated $2.4B in revenue.

- Broadcast TV OTA (+0.2 percent), TV Digital (+4.9 percent) and Radio Digital (+4.1 percent) will see small increases even in this non-political year.

Commenting on the growth of CTV/OTT, BIA’s Managing Director, Rick Ducey, said, “Both linear TV and digital budgets are fueling the growth of CTV/OTT, as well as new dollars from publishers and aggregators that are using the channel to extend their programmatic platform to long tail businesses.”

When examining the top spending sub-verticals, BIA advises that later in the year, growth is expected in Auto, and the company is raising expectations for Tier 3 – New Car Dealers, and Automotive Repair Services. Other important verticals for local advertising where BIA is raising expectations include Savings/Credit Institutions and Other Loan Services, Plumbers and HVAC, and Realtors. Although political will be a huge advertising category in 2024, BIA does anticipate some spending to begin later in 2023.

The updated local advertising forecast for 2023 lowers estimates for Online Gambling, Office Supplies and Stationery Stores, Auto & Direct Property Insurance, Health & Personal Care Stores.

Accessing the Updated 2023 U.S. Local Advertising Forecast

For BIA clients, the company’s BIA ADVantage™ platform and MEDIA Access Pro™ database now contain the updated 2023 U.S. Local Advertising Forecast, which covers 16 media and 96 sub-verticals and includes comprehensive local television and local radio forecast updates and market profile data.

—