BIA’s August forecast update again revised downward to $140 billion the total 2020 ad spending targeting local audience, a 6.1 percent decline from 2019. Of course political spending is an exception, and in this recent forecast update, BIA increased its 2020 estimate for political spend upward to $7.3 billion.

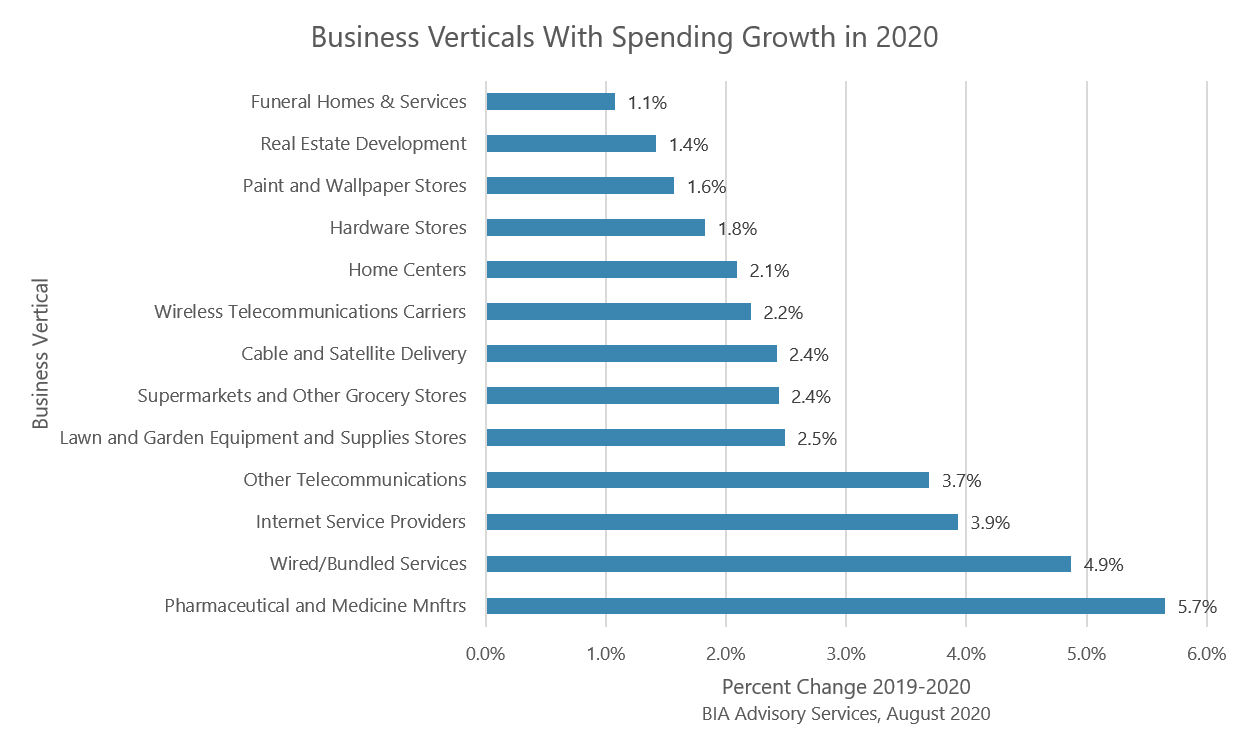

Even with an overall decline in the local ad market, there are pockets of growth beyond political spending. For example, BIA forecasts pharmaceutical and medical brands to increase 2020 spending by 5.7 percent and wired/bundled telecom brands to increase by 4.9 percent.

Here we offer five themes for what’s driving growth across non-political business verticals.

In the chart shown here, we list all the business verticals, excluding political and government spending, showing growth in 2020. As you can see, there is a theme that ties to pandemic-driven behaviors including self-quarantining, Working From Home (WFH), and restrictions on access to restaurants.

Theme 1: We have to fix this place up!

Spending so much time at home leads one to start noticing more things that may have been overlooked previously. And with more free time on their hands without a daily commute, consumers are spending time with DIY home improvements.

Lawn and Garden (+2.5 percent), Home Centers (+2.1 percent), Hardware Stores (+1.8 percent), and finally Paint and Wallpaper Stores (+1.6 percent) are all increasing their paid media buys.

Theme 2: Geez, our Internet is really slow.

Newly minted WFHers transitioning from enterprise-grade telecommunications services to home-based WiFi and consumer-grade data connections are feeling the pain of trying to recreate the level of service they had in their office.

Personal buying and company-sponsored upgrades are necessary to support dramatic increases for bandwidth demand driven by video conferencing and data communications. Consumers are shopping for upgraded telecom services and that’s stimulating more advertising. Wired/Bundled Services (+4.9 percent) and Internet Service Providers (+3.9 percent) top the “I gotta have more bandwidth” list.

Other Telecommunications services (+3.7 percent), Wired Telecommunications Carriers (+2.2 percent) round out the list of telecom and data service companies increasing their ad spending.

Theme 3: Is that all there is on TV?

With more time at home and a bit more leisure time on their hands, media consumption has risen. And this has brought consumers face-to-face with their media packages that may have been purchased years ago. With more screen time, and especially with the rise of OTT, consumers are becoming more educated about choices in TV packages building on the recent cord-cutting phenomena.

In this environment, Cable and Satellite Delivery providers have increased their ad spending by 2.4 percent to help ensure they are in the consideration set as consumers reevaluate their TV packages.

Theme 4: Is there anything to eat around here?

Supermarkets and Other Grocery Stores (+2.4 percent) have increased their advertising to reach the WFH segment who no longer have those easy options for eating out at lunch or, “what the heck, let’s order in tonight.”

At the earlier stages of the pandemic, there was the panic-induced fear of food supply chain issues that stimulated shelf-clearing over-consumption. But now, we’re settling into a more established pattern of consumers just purchasing more food to prepare and eat at home.

Theme 5: Only two things are certain, death and prescriptions.

It’s very sad but the reality is that with a global pandemic comes loss of life. Funeral Homes and Services (+1.1 percent) will increase their 2020 ad spending to reach out to consumers in need of their services.

On the happier side, prior to this final outcome, consumers are more motivated to take care of themselves. Pharmaceutical and Medicine brands (5.7 percent) are showing the most growth of any business vertical in 2020 as they target more ad spending to reach newly health-conscious consumers.

Consumers want to be sure their meds are up to date and well-stocked. And with the new sensitivity to being and staying well, demand for these products is increasing.

Take-Aways:

For media sellers, this baker’s dozen of business verticals that are increasing their ad spending in 2020 may be a good place to look for new or expanded business opportunities outside the political vertical.

Happy hunting.

For our BIA ADVantage clients, log in now to view your local market ad forecasts by media and all 95 sub-verticals. More vertical analysis is also available in the Reports and COVID areas.

Want to discuss your specific market? Email us to set up a discussion.