Nicole Ovadia, VP of Forecasting and Analysis, co-authored this post with Lauren Ross, VP of Media Valuations.

It seems that 2025 is poised to be an intriguing year for local media. With new leadership in Washington and a positive economic outlook, numerous deals and mergers could occur in the coming months and years.

The timing is favorable, given the change in leadership at the Federal Communications Commission (FCC), the new Congress, and improving market conditions. Media companies are eager to grow and adapt, and we are already observing signs of heightened activity in acquisitions and strategic partnerships.

Let’s start by reviewing what we’re seeing and explaining why 2025 could be a pivotal year for media companies.

If we remove Political and Olympic spending, 2024 was challenging for most traditional media operators. Excluding political, local radio and TV advertising was down from 2023 to 2024 due to a lack of organic growth. In general, local businesses tightened their ad budgets in 2024.

2024 also began with high interest rates. Despite three cuts totaling 100 basis points by the Fed in late 2024, the historically elevated interest rates didn’t spur significant activity. Real Estate and Automotive were two sectors that decreased their advertising spending considerably compared to 2023. Plus, inflation concerns and the rising cost of housing and groceries forced consumers to slow their spending and hold off on larger purchases such as cars, travel, and houses.

Lastly, through most of 2024, uncertainty about the Presidential election and the direction the county would head in the next four years had consumers in a “wait and see” pattern.

Now, as we enter 2025, perceptions of the economic climate have shifted. With Trump taking office, many analysts believe that having a Republican in the White House, along with Republican majorities in both the House and Senate, will be beneficial for businesses.

The Federal Reserve is also expected to reduce the funds rate by another percentage point in the coming year, making borrowing—and consequently, acquisitions—more appealing for companies. Additionally, the tax cuts established under the 2017 Tax Cuts and Jobs Act are anticipated to be extended by Congress beyond their expiration date in 2025. Perhaps most importantly, the Republican-led FCC seems interested in revising broadcast ownership rules to better reflect the current competitive landscape.

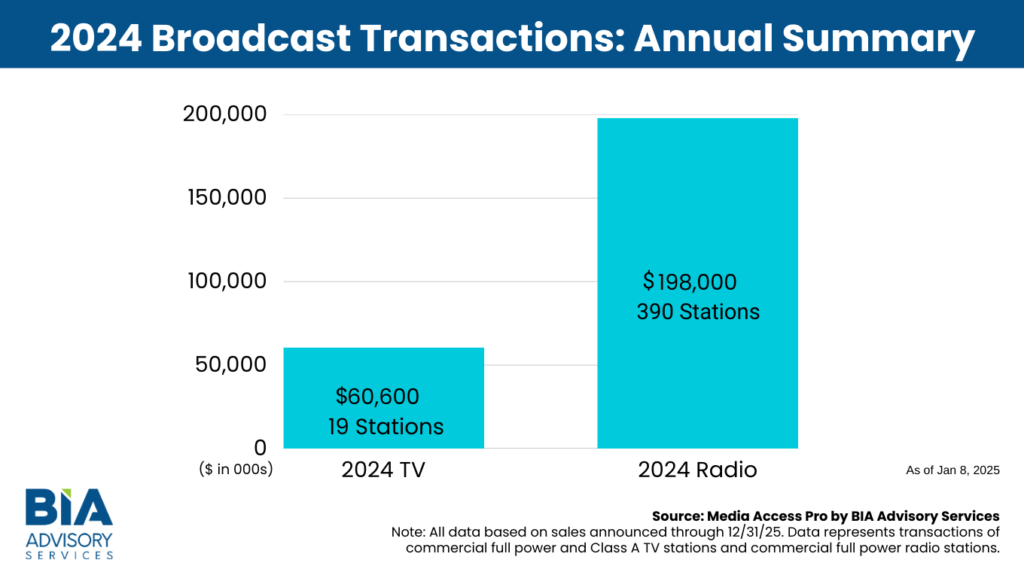

The television industry has experienced notably low merger and acquisition (M&A) activity in recent years. In 2023, 25 full-power and Class A TV stations were sold for $319 million. However, in 2024, the number of stations sold dropped to 19, with a total deal volume of less than $60.6 million. This decline is significant compared to 2021 when TV deal volume exceeded $4.4 billion. Full power, commercial radio transactions totaled $220 million in 2023, declining about 10% in 2024 to $198 million (for 390 stations) compared to $1.1 billion in 2019.

The lack of merger and acquisition activity in the broadcasting industry last year can be attributed to several factors, according to our valuation team leaders, Lauren Ross, Vice President of Media Valuations, and Geoff Price, Vice President of Financial Consulting.

Lauren and Geoff explain that “a valuation gap exists between buyers and sellers, making it challenging to agree on terms, and some buyers have faced difficulties securing capital. Additionally, the Democratic-led FCC quashed and slow walked some TV deals and didn’t act to loosen restrictions on local radio ownership (via the subcaps) or local TV ownership (via the top-four prohibition and the two-to-a-market rule) in the face of changing industry and competitive conditions.”

It remains uncertain whether capital markets will become more accessible to the broadcasting industry in the coming years. But there is renewed hope that a Republican-controlled FCC will speed up the process of granting pending deals and relax ownership regulations, infusing new life into the deal market. We believe conditions are ripe for strategic deals and swaps in both TV and radio.

Another twist that we will be on the lookout for in 2025 is “horizontal merger activity.” Media companies are increasingly merging traditional and digital platforms to meet the needs of clients and advertisers, regardless of the medium. To achieve this, many media companies have formed partnerships and agreements with other organizations, creating a one-stop shop for all advertising needs.

We anticipate that more of these partnerships will evolve into mergers and acquisitions in 2025, with media companies acquiring ad agencies or demand-side platforms (DSPs), or vice versa. Historically, large media companies have concentrated on broad coverage, aiming to reach as many viewers or listeners as possible.

As consumer behavior evolves, audiences are redefined, allowing media companies to better respond by offering advertisers a single platform to access all media that target consumers engage with.

We expect 2025 to be a significant year for companies, and we look forward to continuing our analysis of their activities here in this blog, in our newsletter, and on our podcast throughout 2025.

If you are considering a transaction or need a valuation for any purpose, and would like to speak with our valuation team, please email us. We also provide stick value calculators for quick assessments. You can find detailed information about all our valuation services here.

Happy New Year, and here’s to a great 2025!