Amazon Prime Day is a key summer spending event for consumers and for Amazon it is a quick way to drive Prime memberships and subscribers to their video service and Fire TV. While Amazon does generate a lot of attention (estimated 121.2 million US Prime subscribers in 2019) and ad revenue, the majority of video ad dollars in 2019 will go to local TV. BIA’s updated U.S. Local Advertising Forecast projects steady growth for the local video segment through 2023.

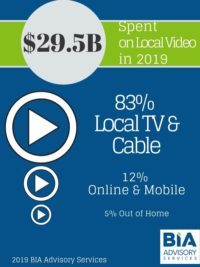

Local Video* is estimated to bring in $29.5 billion (19.9 percent share of total local ad dollars) in 2019. The local video ad market is becoming very competitive with online, out-of-home and mobile video with broadcast TV remaining dominant in capturing local video advertising, even in 2019 without substantial political advertising. As more consumers are cord-cutting and using broadcaster apps to watch videos on tablets and desktops, local online video is growing substantially through 2023 (CAGR +16.6%). Local mobile video advertising is also growing significantly (CAGR +10.5%), as increased mobile usage gives advertisers the ability to target consumers near their points of purchase.

*Includes local Over-the-Air (OTA) TV, local cable, local online video, out-of-home video, mobile video)

BIA’s U.S. Local Advertising Forecast 2019 offers a five-year forecast of the top media including direct mail, local video, online/interactive (i.e,. local search and local display), newspapers, mobile, radio, out-of-home/OOH video, directories (i.e. PYP and IYP), social and local magazines.

The forecast can be purchased separately, or by subscribing to BIA ADVantage.