One of our clients recently asked us for data to help size the market for mid-size and independent agencies versus the Holding Companies and estimate how much is available for local streaming and local TV ad spending. Since this question has come up before, we figured we’d share some data and insights in this blog post.

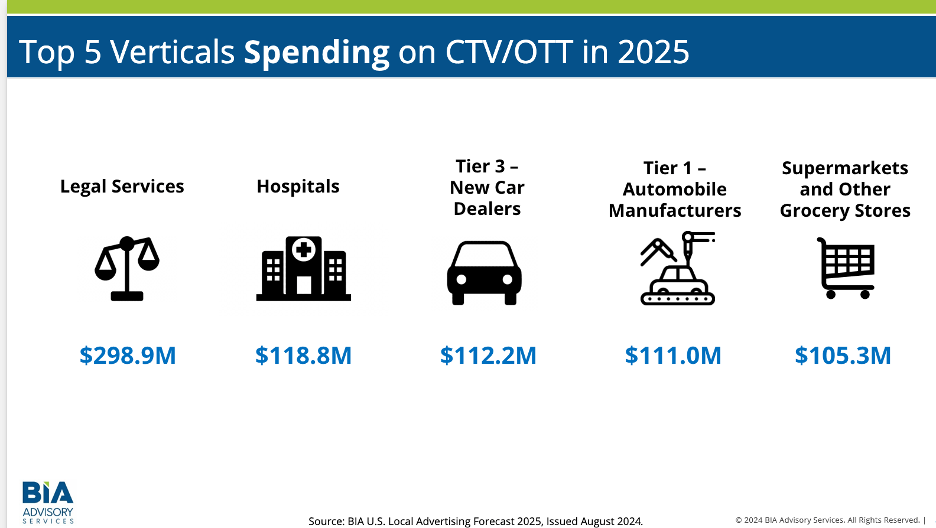

Local Connected TV (CTV) ad spending of course is a high growth area, the fastest among local media. In BIA’s latest U.S. Local Advertising Forecast, the top five spending verticals for local CTV ad inventory, BIA has Legal Services ($298.9 million), Hospitals ($118 million), Tier 3 New Car Dealers ($112 million), Tier 1 Auto Manufacturers ($111.0 million), and Supermarkets/Other Grocery Stores ($105.3 million). This media buying gets placed by brand marketers directly, by Holding Company local media investment groups, and by Independent Agencies. The question for media sellers is – how to prioritize these demand segments.

The ad agency universe is large and diverse with about 14,000 agencies along with the 6 big holding companies. Not all of these agencies buy media, some focus on creative and other aspects of marketing. Some agencies focus on traditional media, others on digital media. Some provide full-service, others might specialize in verticals like Auto, Healthcare, Education, etc. The 4A’s has a useful tool for finding member agencies with different specializations and attributes. Click here to learn more this 4A’s agency finder tool.

Advertiser Perceptions just published a report that provides insightful information about agency segmentation and demand for ad inventory, Changing Industry Dynamics: How Shifts in Ad Spending and the Role of AI in Media Buying and Planning Are Changing the Agency-Marketer Relationship. We definitely commend this report, for those interested in this question your time spent reviewing it will be well spent.

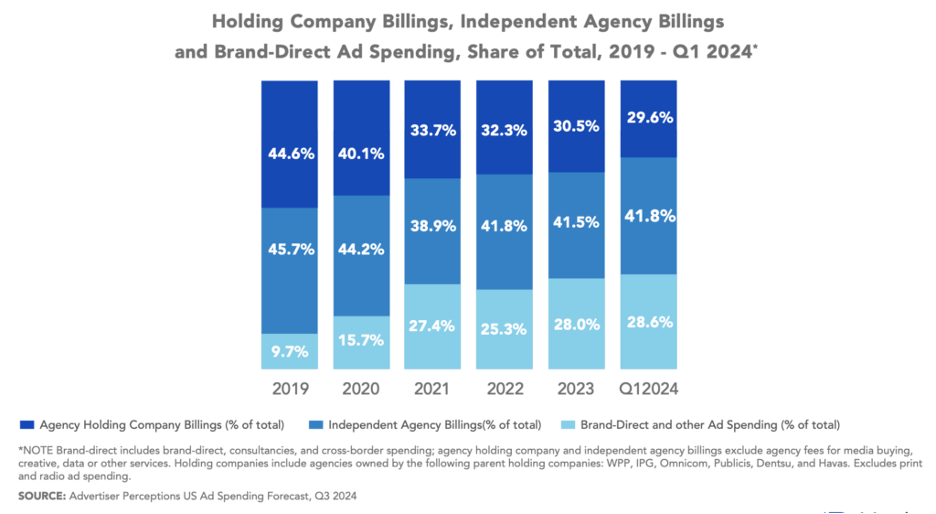

The Advertiser Perceptions study broke out media spending by agency billings and brand-direct buying. Pre-pandemic the Holding Companies billed 45 percent of U.S. ad spending while Independent Agencies billed just a bit more at 45.7 percent. Brand marketers (and other ad spending) accounted for less than 10 percent of ad spending. That segmentation changed dramatically over the past several years, and we hope media sellers have kept us with this share shift.

By the first 1st quarter of 2024 the Advertiser Perception data shows us that the Holding Company share plummeted to 29.6 percent of ad spending while Brand-Direct buying rose nearly three-fold from 9.7 percent to 28.6 percent of ad spending. The Independent Agencies held their own, dropping just a few points from 45.7 percent to 41.8 percent.

The big news in these data, Brand-Direct marketers are managing more of their ad buying and Independent Agencies now command the largest ad-buying segment. Media sellers tracking these market developments will want to change their sales prioritization to seek revenue growth to where the ad buying has shifted.

These data are for all media, not just local. We suspect brand-direct buying is less of a factor in local but do believe the Independent Agencies are the biggest segment. The local investment groups at the Holding Companies also have a bigger share of local media buying than the overall trends shown in this chart.

While this is interesting intel, it’s still a big job try to sell media into these segments.. Advertiser Perceptions reports that the Holding Companies has almost 24,000 people influencing media buying with more than 37,000 additional influencers at the Independent Agencies. These number pale in comparison to the more than 680,000 people working in advertising and marketing at the brand level.

And it’s actually a big job trying to buy media from the agencies’ point of view. AI tools quickly are coming into media campaigns. Initially, it’s more Gen AI being used for creative and content production. But with the kinds of audience and media performance data being generated, AI models will be refined to help optimize cross -media Local TV and Local CTV campaigns. Then the local media sellers will have to navigate not just hundreds of thousands of influencers at the Holding Companies, Independent Agencies and Brand…but all their AI models as well.

Looking ahead, the impact of AI, both generative AI and various types of campaign planning and optimization AI models will rule the day. Knowing where the demand for ad inventory among these segments lies is a good piece of intel. But the path to winning that buying, even in local media, will be increasingly impacted by AI and its ability to optimize content, and media mix models. And AI may also be helpful to media sellers trying to increase fill rates. See this piece by John Accarrino, CTV Advertising Has An Embarrassing Fill Rate and Frequency Problem. Can AI Fix It?