The coronavirus pandemic clearly is a headwind, but demand for zoned broadcast radio advertising, should it be offered, signals a welcome tailwind for local radio advertising growth with the majority of both Main Street and Madison Avenue advertisers expressing likelihood of greater radio spending with over-the-air geotargeting.

MAGNA Global’s EVP Local Investment, Kathy Doyle and Justin Fromm, EVP Business Intelligence at Advertiser Perceptions, joinedBIA’s managing director Rick Ducey in an online discussion (now available on-demand here, or download just the deck here) to share research and insights on these divergent trends.

Pandemic pandemonium: MAGNA’s Kathy Doyle shared that while we certainly could see marketing budgets hit hard, for now, it’s more of shifting ad spending rather than canceling it outright. Across IPG, Doyle says there are multiple daily conference calls among the agencies and with clients. It’s a busy time.

What’s happened to drive time? For local radio specifically, Doyle voiced frustration that, “With all of the shelter-in-place and non-essential travel restrictions ordered by state and local governments, it’s critical to get more visibility into how in-car listening is impacted. But we can’t get a bead on this and that’s causing trepidation for radio buyers.”

More shifting than canceling in some verticals. Doyle noted that it’s a crazy time. Even with brands that want to advertise, losing access to premium sports inventory (March Madness, etc.) means having to shift local activations around a lot. Auto brands seem to be holding tight, pushing April campaigns into May and June rather than canceling. But they do have a supply chain problem. Once the inventory on the lot is sold, Auto will be challenged to produce more product, and without that product there’s less need to advertise. “On the other hand, some brands like Coke are shifting their messaging to PSAs rather than commercial ads, keeping their spending but shifting goals.” QSRs and restaurants, either shut-down or limited to curbside takeout and delivery are hard hit.

Ad buyers will spend more on radio stations offering over-the-air geotargeting. Back to the webinar’s original theme, local radio stations and over-the-air geotargeting of ads and other content.

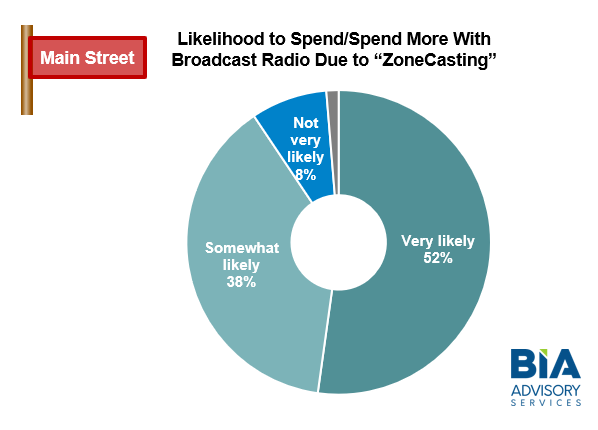

Main Street and Madison Avenue Radio buyers who want geotargeting are more likely to spend more on radio. Both the BIA and Advertiser Perception surveys of “Main Street” businesses and “Madison Avenue” agencies and brands show strong awareness and use of geotargeting and interest and intent to spend more in local radio if they can offer geotargeting.

Advertiser Perception’s Justin Fromm noted that nearly half of the national brands and agencies in their survey would be “very likely” (11 percent) or “somewhat likely” (38 percent) to spend more on local radio stations offering geotargeting over-the-air. Ducey reported this figure jumps to 90 percent likelihood for Main Street advertisers to buy more radio, with 55 percent saying they are “very likely” and 38 percent saying they would be more radio with geotargeting.

Disclosures: Advertiser Perceptions’ “Madison Avenue” study was independently funded and administered. BIA’s “Main Street” survey was developed to complement the AP study for deeper insights and was funded by our client, GeoBroadcast Solutions, the company seeking FCC approval to offer its ZoneCasting technology to the radio industry. To learn more about radio and over-the-air geotargeted zoned broadcasting, please contact GeoBroadcast Solutions.