In this edition of BIA Advisory Services’ Vantage Points series Zach Cross, President, Revenue Analytics has a conversation with BIA’s managing director Rick Ducey about the impact of COVID-19 on media inventory, demand, and pricing strategies.

The Vantage Point series taps the perspectives of various lookout points from around the local media and tech sectors. Email us to discuss a topic for consideration.

Rick Ducey: Zach, your firm specializes in helping media clients make decisions about inventory and pricing with the goal of driving uplift in revenue. It’s a crazy time now with audience impressions seeing double digit increases but ad spending and CPM pricing in decline.

BIA just published a report, Advertising Revenue in an Uncertain COVID-19 Environment, in which we estimate the total local advertising market for all of 2020 will be $144.3 billion, a 10.6 percent decrease from BIA’s prior estimate of $161.3 billion in November 2019. The new estimate also represents a 3.6 percent decline from 2019, even with the added political advertising revenue of $7.1 billion anticipated this year.

In this market environment, how can publishers make the best decisions about pricing their inventory to maximize revenue?

Zach Cross: It’s a good question and of course, we’re getting a lot of that from our media clients. What we’re seeing is that there are specific, data-driven and operational decisions that publishers must take now to survive. The key insight is that this economy is unlike what we’ve seen previously.

In particular, demand as you point out, looks different from previous periods. Data and insights feeding pricing algorithms from this pandemic period will become part of the historic data but decisions have to be now in real-time without an over reliance on data from previous periods that are not reflective of the current and forecast situation.

Rick Ducey: Well clearly publishers and buyers have been moving into a marketplace that is much more informed by data in terms of consumer and audience segmentation and then activating those audience in media buying. Of course this has long been the practice in digital media but it’s becoming much more common in linear media like broadcast, cable and radio. So we’re in a situation where we have hundreds of first-party and third-party data sources but the coronavirus epidemic is a new pattern that AI must still learn.

How can publishers make the best decisions about inventory and pricing relative to demand?

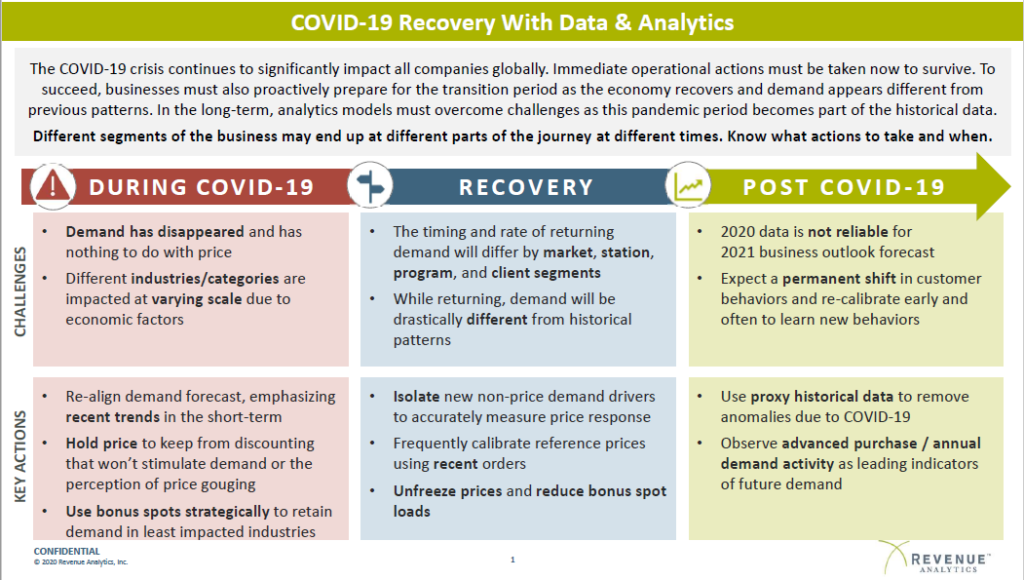

Zach Cross: We break this down into three phases: (1) During COVID-19, (2) Recovery, and (3) Post COVID-19. What we believe is that different segments of the business will have their own recovery curves. The key is to know what actions to take and when.

BIA has done work in this area to show how COVID-19 will impact business verticals and geographies differently. We need to factor these data into inventory management and pricing decisions. But we must also remember that demand forecasting models are informed by past patterns and with the impact of COVID-19 we are seeing a new pattern. This is a time where it’s critical to really study the market forces and layer in human judgement on top of what the AI is telling us.

Rick Ducey: Can you walk us through the procedure you recommend?

Zach Cross Definitely. As you can see from our chart, we recommend you develop different data-driven strategies for each of the three phases.

During COVID-19 In this phase we’ll see a disruption of the supply and demand curve. Demand will disappear and it will have nothing to do with price. As BIA data shows, ad spending is down and this trend is relatively inelastic to price. There’s just a solid drop in demand almost regardless of pricing. However, different business verticals are impacted differently both in levels and timing of demand.

It’s critical to study the data and parse out these trends. In this phase, what we recommend is to realign your demand forecast and more heavily weight recent trends in the pricing algorithms.

Even though plummeting demand signals an opportunity to drop pricing to generate revenue lift, we think it’s a smarter move to hold back excessive discounting because you’re essentially using a pricing strategy to chase demand that’s not there. Use bonus spots strategically to preserve inventory that can be used in lesser impacted industries and “essential businesses” that are still open.

Recovery I know that BIA’s estimating that late Q1 and into Q3 is when we’ll face the brunt of the COVID-19. In that case, as we look to Q3 and Q4 we’d expect to enter the Recovery phase.

Again, as BIA has pointed out, the recovery will not be uniform across the country and business verticals. Our expectation is that demand will differ by market, station, program and client segments. All these factors must work into your pricing and inventory algorithms. And again, let me emphasize we can’t rely on historical patterns to guide us, we’re in uncharted territory here.

So the thing to do in a novel situation is isolate what are the new non-price demand drivers. If we can do that, we’ll get much better visibility and accuracy into understanding of how to measure price responses.

For example, in the QSR vertical, with so many businesses shut-down or engaged in reduced operations, inventory pricing just won’t stimulate demand that’s not there. And of course with the historically high unemployment, even where QSRs may be at least partially open, the consumer demand is depressed. This is a new type of non-price demand driver we need to factor into our analytics.

Again, the thing to do here is overweight recency. Frequently calibrate reference prices based on recent orders. Protect inventory by unfreezing prices and managed reduced bonus spot loads.

Post COVID-19 Eventually, this pandemic will pass and we’ll move back to a new normal. Looking ahead to 2021, it’s critical to understand that 2020 data will not be a reliable basis for your 2021 revenue forecasts.

For 2021 and beyond we must look for emergent non-price demand drivers as well as the usual demand driver suspects. There will be permanent changes in consumer behavior such as working from home, media consumption patterns, shopping online, and different expectations for brand relationships. No one knows for sure where this journey will bring us. The smart thing to do is re-calibrate early and often to detect these shifts and factor them into your models.

Rather than 2020 historical data which will be challenged to provide accurate insights into the POST COVID-19 marketplace, we recommend using proxy historical data that removes the kinds of anomalies we’re able to measure and attribute to the pandemic.

In linear media, there actually is an advantage over digital media in predicting future demand as the inventory is secured based on a forward reserve booking model. It is very important to observe and analyze these advance purchases in light of seasonal and annual demand activity as leading indicators of future demand.

Rick Ducey: Zach, this has been a terrifically insightful and informative discussion. Thank you!

Zach Cross: You’re welcome. These are challenging times, but we’re confident that we will get through this. Insightful analyses and observations of what’s going on the market and being open to deviating from the norm in inventory and pricing decisions with data-driven analytics will be a big part of getting your businesses to a better place all that much sooner.