Multi-location brands including franchisees, regional businesses and channel partners have moved increasing amounts of their marketing strategies and media activations into digital to derive the benefits of audience targeting and ROI analytics these media platforms offer. The challenges brought on by the COVID-19 pandemic changed media and consumption habits so much that multi-location business, along with everyone else, had to make quick change-ups.

For media sellers, the opportunity to approach these multi-location businesses with omni-channel solutions is very strong as they struggle to deal with these market shifts. Traditional and digital advertising work in tandem but it’s not always clear to businesses how to achieve the best balance for maximum impact. Media sellers can offer the wisdom of their experience and knowledge of modern marketing solutions.

In particular, one example we highlight below is the OTT case. BIA forecasts local OTT spending will reach about $1 billion in 2020, rising 20 percent to $1.2 billion in 2021. As we will see below, there remain a huge, untapped opportunity just in this one local ad channel.

Business verticals embrace digital advertising at different levels. For example, in the Dallas-Fort Worth market, according to BIA ADVantage ad forecast data, Tier 2 Auto Dealers will invest 44.5 percent of their media spending in digital for 2020 and increase this to 45.8 percent in 2021. On the other hand, hardware stores in this market will spend only 30.1 percent of their media budget in digital for 2020, increasing just a bit to 30.9 percent in 2021.

Digging into the mind sets of several dozen multi-location marketers in different verticals, Netsertive just released a fresh set of pandemic era research findings in the new report, The State of Digital Advertising for Multi-Location Businesses, to help guide media sellers better understand the needs of these businesses.

Here are the top 10 findings from this research:

- Truly Localized Digital Advertising Programs are an Untapped Opportunity.

- The Local Shopping Experience Has Changed, but a Physical Presence Is Still More Important Than Ever.

- Marketing Teams Are Defaulting to Google and Facebook Campaigns, Missing Out on Multi-Channel #3 Opportunities.

- In Search of ROI, Marketers Are Focused 4 on Attributable Digital Channels.

- Data is Everywhere, Yet Marketers Still Struggle to Measure ROI.

- Connected TV Advertising is an Untapped Opportunity for Multi-Location Marketers.

- Corporate and Local Stakeholders Face Friction When Collaborating on Campaigns.

- Marketers Struggle to Implement Technology 8to Scale Local Advertising Programs.

- Marketers Realize the Need for Agility to Prepare for the Unknown.

- Localized Content Is King.

One change that comes through loud and clear in the pandemic era is the massive behavioral change consumers have shown in their adoption of OTT/CTV media consumption on both SVOD and AVOD/FAST channels. Subscription Video on Demand (SVOD) services such as Netflix have attracted much more viewing of course, but these impressions are not available to advertisers as Netflix is a no-ad, pay only channel.

Other OTT platforms, brands and channels such as Roku, Hulu, and local aggregators of OTT inventory such as Premion and CompulseOTT have made targeting local OTT impressions much more effective. Ad-Supported Video on Demand (AVOD) and Free Ad-Supported Streaming Video (FAST) platforms have shown high growth in viewership and ad spending during the pandemic.

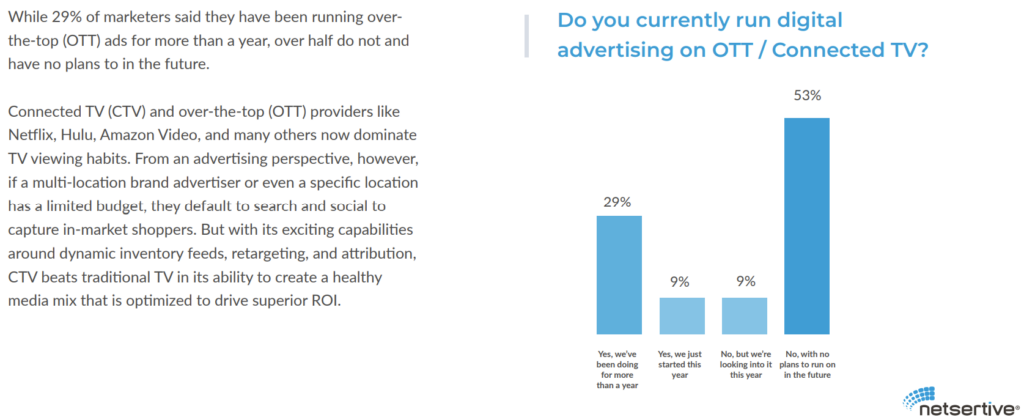

You’d think OTT might be on the top of multi-location marketers’ minds given this massive and recent change in consumers’ media behavior. Nonetheless, Netsertive found in its study that over half (53 percent) of these markets not only do not run OTT ad campaigns, but have no plans to do so. Now, consider how much more digital Tier 2 Auto is versus Hardware Stores. The opportunity for media sellers to educate multi-location marketers on the benefits of adding digital into their media mix should be very attractive. Both parties can win with more effective utilization of omnichannel strategies.

The marketing problem multi-location businesses face is a daunting one. As Netsertive puts it in their report there may be lots of attractive media options, “However, the amount of data, localization, and change is clearly overwhelming for multilocation businesses, many with dozens, hundreds, or even thousands of different locations, markets, target audiences, and local stakeholders to attend to. So while there are more opportunities to reach shoppers digitally than ever before, there’s also greater pressure to understand attribution.”

This a challenge local media sellers can take to help multi-location marketers get smarter and activate their media strategies and plans much more effectively.

Netsertive is making the report, The State of Digital Advertising for Multi-Location Businesses, downloadable here.