The adjustment in local advertising revenue is mainly due to a decrease in digital advertising plus a slow economic start to the year.

Chantilly, VA (June 28, 2023) – BIA Advisory Services has decreased its 2023 U.S. Local Advertising Forecast estimate to $161.7 billion, from its original estimate of $165.7 billion due to a mixed start in the economy this year and the tempered growth in digital advertising. The updated local advertising forecast for 16 media and 96 sub-verticals is now available on the BIA ADVantage™ platform and local television revenue has been updated in the MEDIA Access Pro™ database.

“After Meta, Alphabet and others lowered expectations for 2023, we examined local digital advertising spending revenues over the first six months of the year and determined a reduction was necessary,” said Nicole Ovadia, VP Forecasting and Analysis, BIA Advisory Services. “After years of double-digit growth, we are seeing some headwinds that will have a significant impact on digital local advertising. For traditional media, while we’ve made changes to certain media and categories throughout our forecast, the total ad forecast for this segment remains consistent with our original expectations.”

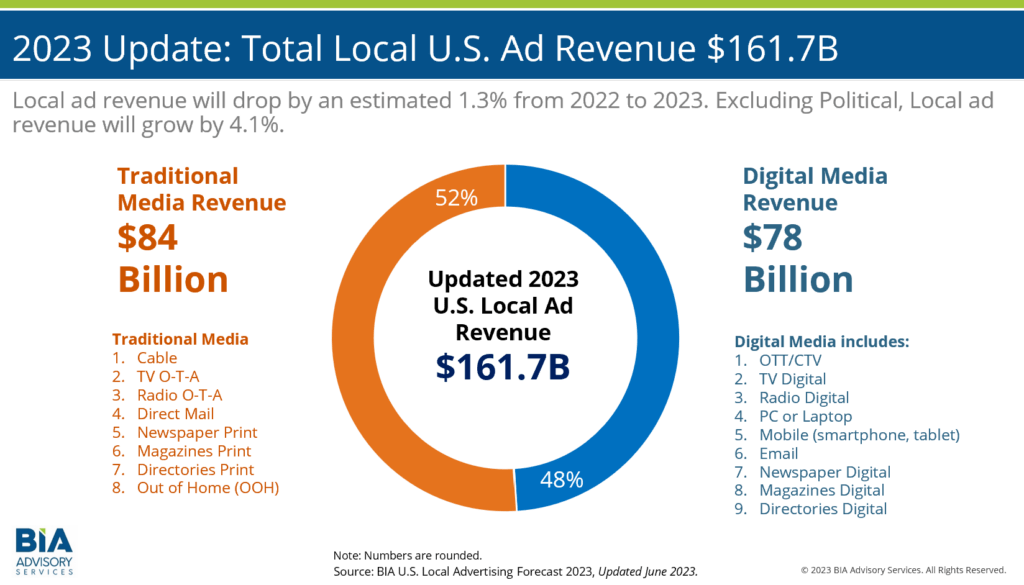

BIA’s updated U.S. Local Advertising Forecast for 2023 shows traditional media will earn $84 billion, with digital revenue reduced from an original estimate of $81 billion to $78 billion. BIA defines TV digital to include all digital advertising sold by local broadcast stations excluding Connected TV/Over-the-Top (CTV/OTT). This includes mobile apps, search, social, Owned & Operated inventory, banner ads, etc.

Taking political out of the expected ad spend this year, key indicators for media channels in 2023 include the following:

- The top three paid media channels for 2023 include Direct Mail ($37B), Mobile ($32B), and PC/Laptop ($28B).

- CTV/OTT is still slated to be the fastest-growing (18.5 percent this year), with an estimated $2.4B in revenue.

- Broadcast TV OTA (+0.2 percent), TV Digital (+4.9 percent) and Radio Digital (+4.1 percent) will see small increases even in this non-political year.

Commenting on the growth of CTV/OTT, BIA’s Managing Director, Rick Ducey, said, “Both linear TV and digital budgets are fueling the growth of CTV/OTT, as well as new dollars from publishers and aggregators that are using the channel to extend their programmatic platform to long tail businesses.”

When examining the top spending sub-verticals, BIA advises that later in the year, growth is expected in Auto, and the company is raising expectations for Tier 3 – New Car Dealers, and Automotive Repair Services. Other important verticals for local advertising where BIA is raising expectations include Savings/Credit Institutions and Other Loan Services, Plumbers and HVAC, and Realtors. Although political will be a huge advertising category in 2024, BIA does anticipate some spending to begin later in 2023.

The updated local advertising forecast for 2023 lowers estimates for Online Gambling, Office Supplies and Stationery Stores, Auto & Direct Property Insurance, Health & Personal Care Stores.

Accessing the Updated 2023 U.S. Local Advertising Forecast

For BIA clients, the company’s BIA ADVantage™ platform and MEDIA Access Pro™ database now contain the updated 2023 U.S. Local Advertising Forecast, which covers 16 media and 96 sub-verticals and includes comprehensive local television and local radio forecast updates and market profile data.

About BIA Advisory Services

BIA Advisory Services is the leading authority for data-centered insights, analysis, strategic consulting, and valuation services for the local media industry. Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantageTM service to help clients discover the path to their best opportunities. Learn more about our offerings at https://www.bia.com.

Media Contacts:

| MacKenzie Lovings (703) 802-2991 mlovings@bia.com | Robert Udowitz (703) 621-8060 rudowitz@bia.com |