New state-of-the-industry report shows local radio stations with fourth largest share of local ad revenues, behind direct mail, newspapers and TV

CHANTILLY, Va. (Nov. 12, 2013) – The local radio market is growing, albeit at a more moderate pace than it once did, by expanding its offerings to off-air platforms, providing a wider range of listener experiences and advertiser opportunities, according to the firm’s new state-of-the-industry report. Local Radio Stations Profiles and Trends for 2014 and Beyond provides a comprehensive view of the industry based on the long-term research and analysis conducted by BIA/Kelsey for its clients and the industry.

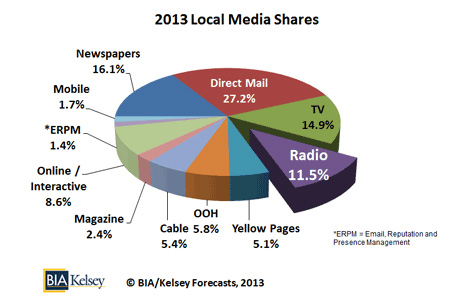

Defining the local media marketplace as all local media/services that provide access to local audiences, BIA/Kelsey estimates total local media spending for 2013 to be $132.7 billion. This marketplace includes all of the media that local radio stations compete against for national and local advertising spending in their markets. Based on this definition of local advertising, local radio stations receive 11.5 percent of all advertising revenue being spent in local markets, fourth amongst all local media segments, behind direct mail (27.2 percent), newspapers (16.1 percent) and TV (14.9 percent).

“As we move toward 2014, it’s clear the radio industry has adapted to incredible competition from all sides, with streaming and other audio competitors taking audiences,” said Mark Fratrik, chief economist and report author, BIA/Kelsey. “Yet local radio is surviving, and in some instances, thriving, and poised to compete well in the new marketplace. Radio is also beginning to deliver other compelling digital services that help its local advertisers navigate promotional opportunities. With the right attitude towards the new reality of increased competition and strategic planning, local radio stations can prosper.”

As local radio works to keep pace with digital innovation, the landscape of radio advertisers reveals an attractive and diverse group. Local radio generates over 10 percent of its advertising from five different groups of advertisers: retail (18.0 percent of total radio industry revenue), financial/Insurance (17.0 percent), restaurants (14.5 percent), automotive (14.0 percent) and technology (10.0 percent).

Nationally, BIA/Kelsey’s Media Ad View Plus forecast reveals local radio stations receive 14.3 percent of all advertising spent by finance and insurance companies and 12.1 percent of all advertising spending by restaurants. This diversity of advertisers, along with the strong market share with those advertisers, indicates radio remains an important part of the advertising mix for several groups of national and local advertisers.

Another indication of the success of the radio industry’s performance is the recent increase in values of publicly traded radio companies. Like other local media companies, values of public radio companies have increased by 68.2 percent through the first three quarters of 2013, easily beating the performance of the overall stock market. But as competition for audience share continues to cut into audience share for radio stations, the industry needs to be on its toes to remain competitively viable.

Availability of Report and Presentation

“Local Radio Stations Profiles and Trends for 2014 and Beyond” is presented as a 65-plus-page report and a companion presentation.

The report delivers a comprehensive assessment of the radio industry and is useful resources for anyone focused on the trends and direction of local radio, including radio groups and financial institutions and companies building interactive digital solutions being embraced by the industry.

The report includes the following analysis and information:

- Revenue history of local radio stations

- Overall industry growth

- Competitive threats to local radio stations

- Revenue share by format

- Radio’s position in the new media marketplace • Radio advertisers and competition for advertisers

- Radio’s share with advertiser and business categories

- Technology changes in radio Industry

- Consolidation in the industry

- Digital sales transformation playbook

Accompanying the report is a companion presentation summarizing the top findings from the report. This asset is valuable when creating custom presentations for board and financing meetings and strategic retreats.

The report is available for purchase ($1,095 for the report and companion presentation, or $2,500 for the report, presentation and one-hour custom analyst briefing). More information about the report and how to purchase it is available at www.biakelsey.com/Research-and-Analysis/Reports/State-of-the-Industry-Radio or by emailing sales@biakelsey.com.

About BIA/Kelsey

BIA/Kelsey advises companies in the local media space through consulting and valuation services, research and forecasts, Custom Advisory Services and conferences. Since 1983 BIA/Kelsey has been a resource to the media, mobile advertising, telecommunications, Yellow Pages and electronic directory markets, as well as to government agencies, law firms and investment companies looking to understand trends and revenue drivers. BIA/Kelsey’s annual conferences draw executives from across industries seeking expert guidance on how companies are finding innovative ways to grow. Additional information is available at https://www.bia.com, on the company’s Local Media Watch blog, Twitter (http://twitter.com/BIAKelsey) and Facebook (http://www.facebook.com/biakelsey). Stay connected by subscribing to the firm’s bi-monthly newsletter.

For more information contact:

Eileen Pacheco

For BIA/Kelsey

(508) 888-7478

eileen@tango-group.com

Robert Udowitz

For BIA/Kelsey

(703) 621-8060

rudowtiz@biakelsey.com