Search has always been one of the strongest indicators of offline user intent. And offline is where it’s at, as we’ve been saying for years. E-commerce is about $300B in the U.S.. But offline spend — mostly local — is more like $7 Trillion.

Though search has a big influence on that offline activity, it’s somewhat “aspirational” as a barometer for user intent, and thus ad targeting. Wouldn’t actual consumer behavior be a better indicator of intent that what you search for?

This is behind much of xAd’s product development. About two years ago, it launched Footprints to track consumer foot traffic. After a year of monitoring these patterns it had a robust corpus of place data, which led to Blueprints.

Then, earlier this year xAd utilized all of that Blueprints data to launch MarketPlace at Mobile World Congress. Set up as a self-serve tool, brands can bid on real world locations, just as they would bid on search terms a la Adwords.

The platform is built around specific customer profiles like “Mercedes Enthusiasts.” Targeting is driven by Blueprints data such as who has visited a dealer lot. It can target places or the people who have visited those places in the past.

“We believe that where you actually go in the real world is a much better predictor of intent that just searching for something,” xAd head of platform Dan Hight told me. “You’re actually doing something, not planning how to do it.”

A lot of companies talk a big game about location targeting, but most are doing it wrong and giving the practice a bad name. The only way to really pull it off is with a large sample group and meter-level accuracy about locations.

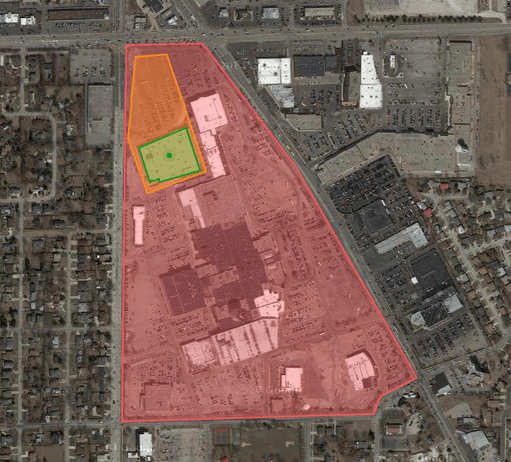

Blueprints prides itself in that level of precision — especially in dense urban areas or shopping centers. It forms targeting polygons that are the exact shape of a building, separating it from adjacent stores or even its own parking lot.

This goes beyond ad network tactics like reverse IP lookups, which infer locations that can be off by miles. Location targeting can also involve radial geofences or symmetrical tiles… but the real world doesn’t fit into circles and squares.

Next up for xAd could be to apply all this consumer tracking and place data to areas other than ad targeting. As we’ve mentioned, working with businesses on operational levels can lock in deeper relationships than running ad campaigns.

We’re talking things like supply chain logistics, inventory management and deciding where new stores should go. Lots of these types of functions can be informed by consumer behavior and spatial patterns.

And if xAd can position a self-serve Saas tool for brands to make marketing and operational decisions, it could really start to scale the location data opportunity. This is especially true for multi-location brands with lots of moving parts.

Much of this is our analyst speculation, rather than the company’s explicit road map. But some of these directions could make sense and we’ll be watching closely as things play out.